G’day All,

Hope you’re well and looking forward to Spring!

It’s been a while since our last update so here’s a quick snapshot on the latest:

Interest Rates

Inflation is still above 3% with main contributors being rents (high immigration and low construction) and energy prices (we export most of our gas overseas). As inflation slowly drops, expect rates to remain on hold until early next year (2025).

It’s likely the USA will begin cutting rates over the next few months as unemployment and GDP numbers begin to trend unfavourably. Notably, New Zealand has already started cutting rates.

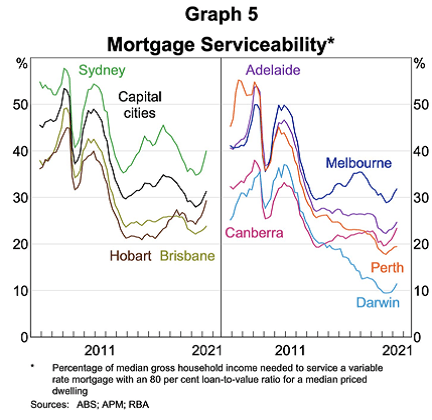

Once rate cuts begin at home – and it is just a matter of time – this boosts affordability/serviceability which correlates to increased property and share prices. Most economists foresee rates eventually decreasing 0.85% to a cash rate of 3.5% (currently 4.35%).

Construction

As mentioned previously, insolvencies in the construction sector are still high. Main causes are inflation in building materials (+35% since 2020) and wages (a lot of tradies left the industry during covid lockdowns and re-skilling/re-licensing isn’t a quick process). Another factor is high government/infrastructure spending which directly competes for availability of trades and materials.

All of this works to increase prices on established property as replacement costs have increased. Whilst it’s certainly more expensive to build now compared to 3-4 years ago, there are still investment-grade packages available with reputable and well-managed builders…they’re just a tad harder to find.

18.6 year Real-Estate Cycle

As we approach the expected 2026 peak in USA land/property values, Australian property (Sydney & Melbourne) is expected to continue its run through to around 2028 (due to lower interest rates and high immigration).

As we move further into the commodities, agriculture and defence/military upswing, the Perth, Darwin, Brisbane and Adelaide markets will likely continue their upward trends through to 2030. Strategically, the key will be to acquire and hold in the commodities and defence markets before leap-frogging into the much bigger Sydney/Melbourne markets around 2030-32 when a correction is anticipated.

Success Story

As previously outlined here, Defencewealth has seen its client’s total portfolio increase further to $16.6million with focus markets being greater Brisbane, Toowoomba, Perth, Adelaide and the Hunter/Newcastle region. One of our clients who built his first property in Brisbane in 2017 for $458k has seen that property now grow to circa $760k. He then acquired a second property in Perth in 2021 for $437k which is now valued circa $650k.

Although there was heightened risk, uncertainty and delays during construction due to the pandemic, a sound knowledge of market cycles gave confidence to continue. In the space of seven years, he’s amassed $515,000 in gross equity all by the age of 35 and optimised his tax position all whilst serving full-time. This sets him up extremely well to either continue investing for compound growth and with reduced risk, or cash-out and fund lifestyle, or a mixture of both.

Strategy

The Defencewealth strategy of TWO-50-TEN™ is based on acquiring a $2 million portfolio at 80-90% LVR over a 6-8 year timeframe. Once acquired we work to reduce the LVR to 50% over the next 4-7 years using a combination of capital growth, offset accounts and principal repayments. Once at 50% LVR, you will have some serious financial options but it will take time (min 10-15 years) to achieve. The new property packages we recommend are considered investment-grade based on experience and results and are selected for their balance in anticipated cash flow, capital growth and risk.

Our very experienced team can assist in all aspects of finance, tax and new property/asset selection and with constant reference to market cycles and intelligence. Please don’t hesitate to get in touch!